The Korean company has been staffing up a explore and development center in Austin, Texas, recruiting engineers from U.S. companies that include some famous people from Advanced Micro Devices. In the latest development, Samsung has hired Patrick Patla, a past AMD vice president who served until Friday as general manager of the business that includes server chips.

Profiles on LinkedIn show workers in the past year that include Jim Merged, a 16-year AMD veteran who was a vice president and chief engineer, and Brad Burgess, who was chief architect of a low-power AMD processor design known as Bobcat. The Samsung center is headed by Keith Hawkins, one more AMD veteran who also worked at server maker Sun Microsystems.

Some of the new Samsung engineers have knowledge in multi-function products known as systems on a chip, or SoCs, which are widely used in mobile devices to save on space and power. But the same approach can be used in servers to save on power, with some companies also forecasting to make SoCs for servers using processor designs from ARM Holdings that Samsung any many others use in cellphones.

One company working on such goods is Calxeda, an Austin start-up that is collaborating with Hewlett-Packard and interprets Samsung’s hiring as a sign it will follow suit.

“They are indeed adding the same skill set,” says Karl Freund, Calxeda’s vice president of promote. “They are expecting to gear up to get into the server space.”

A spokesman for Samsung in South Korea established that Patla is now a vice president at the company. He would not comment on the possibility of making server chips.

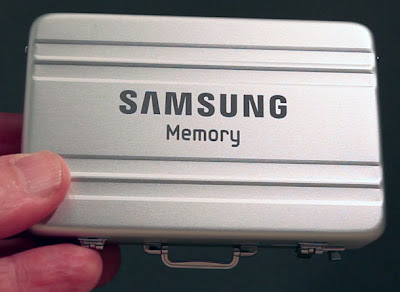

There is no quarrel that Samsung, which is best known for memory Samsung chips, is beefing up efforts to be a bigger player in microprocessors and other goods in the broad grouping known as logic chips. Samsung, besides designing and making its personal mobile processors, manufactures chips designed by Apple for devices that include the iPhone and iPad.

It’s a plan that has put Samsung into opposition with other ARM users such as Qualcomm, Texas Instruments, Nvidia, Freescale Semiconductor and Marvell Technology Group. A move into server chips, in exacting, would intensify competition with Intel, the microprocessor leader that has long been No. 1 in overall semiconductor revenue, with Samsung perennial No. 2.

Patrick Moorhead, a former AMD management who is now president and principal analyst Moor Insights & Strategy, says the ARM-based SoC market is packed out. But Samsung would have advantages in controlling its own manufacturing, where other companies use manufacture services called foundries.

But Samsung would be a greenhorn in server chips, Moorhead notes, and have to build credibility with computer makers and enterprise customers. “They have no knowledge on the server side of the house, unlike Intel and AMD, and will want to prove themselves worthy,” he says.

0 comments:

Post a Comment